When do you have to pay inheritance tax in the UK?

Will solicitors need to know a bit about tax, and particularly inheritance tax, as when someone wants advice on a new Will they want to know if their estate will need to pay tax and if there is anything that they can do to reduce how much their estate will pay in inheritance tax for the benefit of their family and beneficiaries. In this article we look at the basic rules on inheritance tax.

London Will and probate solicitors

For information and advice on writing a Will ,making changes to your existing Will or inheritance tax planning call the specialist Will solicitors at OTS family solicitors on 0203 959 9123 or complete our online enquiry form. Appointments are available through video conferencing, skype or by telephone.

What is inheritance tax?

Inheritance tax is a ‘death tax’ that may be payable by anyone who dies in the UK whose estate is over a certain level. Your estate includes property as well as money and other possessions, such as jewelry or gold. The total amount of your taxable estate is calculated on death to see if there is an inheritance tax liability and, if so, how much.

When you ask a Will solicitor to write a Will you may have no idea of whether your estate will pay inheritance tax or not as there are so many imponderables about how much your estate may be worth in the future and whether the government will change the rules on how much inheritance tax will be payable. A Will solicitor can advise you on your best inheritance strategies to minimize potential inheritance tax payable by your estate. However, inheritance tax planning should be an ongoing strategy as your personal and financial circumstances change.

When is no inheritance tax payable?

It is sometimes easiest to say that when no inheritance tax will be payable on an estate. The current rules say that no tax is payable if:

- The value of the estate is less than £325,000 or

- If your estate is worth more than £325,000 and you give the balance of the estate over £325,000 to your husband, wife or civil partner or to charity.

What are the inheritance tax rules for your home?

If you own a family home then:

- You can leave the property to your husband, wife or civil partner and no inheritance tax will be payable because of the spouse exemption. This exemption does not apply if you are in a cohabiting relationship and you are not married

- If you leave your home or your share in the property to your children or step-children or grandchildren or foster children then then the inheritance tax threshold increases from £325,000 to £500,000 so you could minimise the estate’s inheritance tax liability.

Sometimes people ask if they can give their house away before they die. That is possible but you need to remember that once you have given an asset away you can't ask for the property back if you change your mind or fall out with the person that you gave the property to.

You may want to be able to continue to live in the property until you pass away. The inheritance tax rules say that you can still do this and your estate won't pay inheritance tax on the value of the property provided that:

- You don’t live in the property rent free and instead you pay rent to the new owner at a commercial rent or, in other words, at the rate that a similar property would rent out for. You also pay the bills or your share of the bills. For example, council tax or utility bills. You don’t need to pay rent if you only give part of the property away and the person you give your part of the property to also lives at the property

- You live at the property for at least seven years before you pass away. If you pass away within the seven years then the seven year rule applies

What is the seven year inheritance tax rule?

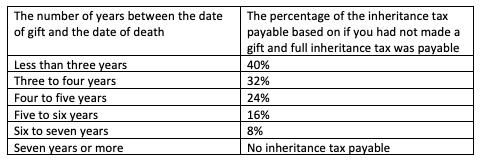

If you give money or property away and survive seven years no inheritance tax is payable. If you don’t survive for more than seven years after making the gift then some inheritance tax may be payable on the value of the gift depending on the value of your estate.

The amount of inheritance tax payable under the seven year rule doesn’t just depend on the size of your estate but also the date of your gift and the date of your death. There is a sliding scale of tax payable:

Can you make other inheritance tax exempt gifts?

You can inheritance tax plan and reduce the size of your taxable estate. Some gifts are not taxable, such as:

- An annual gift allowance of £3,000 per tax year

- Wedding or civil partnership gift of up to £1,000 to a friend or £2,500 to a great grandchild or grandchild or £5,000 to a child

- Gifts out of your income

- Gifts to charity

- Gifts to political parties

- Gifts to support family, such as a child.

How much inheritance tax will my estate pay?

Your Will solicitor can advise you on whether your estate will be subject to any exemptions. If your estate is liable to pay inheritance tax then the tax is payable at the rate of 40% but that is subject to allowances such as your £325,000 allowance or gift allowances.

If you are worried about inheritance tax on your estate and how that might affect your loved ones and family it is best to take legal advice on your best options. For example, some may want to take out life insurance cover to cover the potential tax liability and others may want to tax plan to reduce their potential liability, for example by making lifetime gifts or leaving money to charity.

How to contact OTS Will and family solicitors

To speak to Jayana Rathod a Will solicitor at London based OTS family solicitors about writing a Will , changing your existing Will, estate and inheritance tax planning call us on 0203 959 9123 or complete our online enquiry form. Appointments are available through video conferencing, Skype or by telephone appointment.